is mileage taxable in california

The main arguments for a mileage tax. California Mileage Reimbursement Frequently Asked Questions.

Mileage Reimbursement A Complete Guide Travelperk

Personal Vehicle approved businesstravel expense 056.

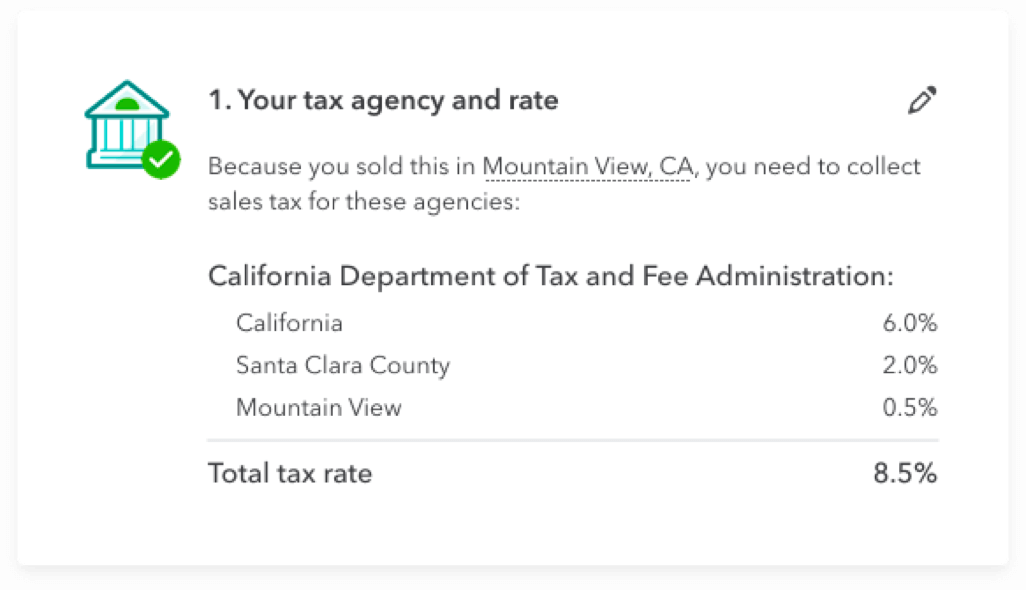

. What transactions are generally subject to sales tax in California. Personal Vehicle state-approved relocation 016. 585 cents per mile driven for business use up 25 cents from.

Most leases are considered continuing sales by california and are thus also subject to. Please visit our State of Emergency Tax Relief page for additional information. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

You dont necessarily have to reimburse employees at that rate but paying a different. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. Mileage Reimbursement In California Timesheets Com.

Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement does not exceed the IRS standard business rate 0625mile for. The short answer is yes mileage reimbursement is taxable if the reimbursement rate exceeds the IRS rateset at 625 cents per mile for 2022. California state and local Democratic politicians are trying to implement a Mileage Tax on all.

Is Mileage Taxable In California. Arguments for mileage tax. The most common travel expense is mileage.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. What Is the IRS Mileage Rate for 2022. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

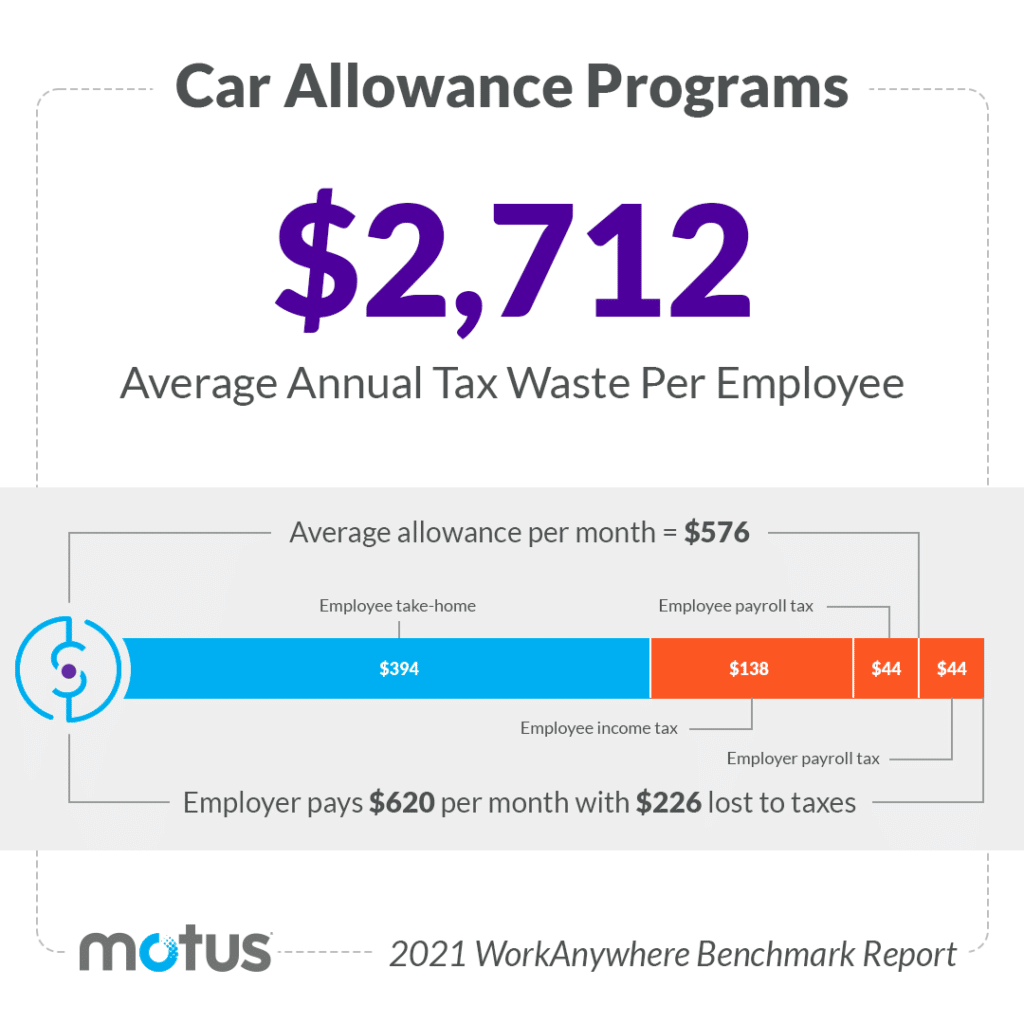

Employees who receive a car allowance were accustomed to being able to write off their business mileage every tax season until the spring of 2019. Get ready for a costly new Mileage Tax on top of what you already pay at the pump. Private Aircraft per statute mile.

Reimbursement Rate per Mile. California isnt alone many states are facing infrastructure issues and not enough funding from traditional gasoline taxes. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

The new rate for. Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be. The IRS rate for 2022 was set at 0585 per mile in December 2021 but.

Most employers reimburse mileage at the IRSs mileage reimbursement rate. When an employer reimburses at. This means that they levy a tax on every gallon of fuel sold.

California state and local Democratic politicians are trying to implement a Mileage Tax on all. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. Employees will receive 575 cents per mile driven for business use the previous rate in.

For these employees the tax cuts amounted. And the California Labor Commissioner has taken the. California requires that a sales tax be collected on all personal property that is being sold to the end consumer for storage.

The standard mileage rate changes every year but for 2021 it stands at 56 cents per mile. The answer is it depends.

2021 Irs Mileage Rates Hrwatchdog

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Irs Raises Standard Mileage Rate For Final Half Of 2022

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

A Primer On Employee Expense Reimbursements In California Lewis Brisbois Bisgaard Smith Llp

How To Claim The Standard Mileage Deduction Get It Back

Understanding Mileage Reimbursement Rules Under California S Prop 22 Measure For Independent Contractors

How The Irs Mileage Rate Violates Ca Labor Code 2802 A

Vehicle Programs The Average Car Allowance In 2022

Irs Lowers Standard Mileage Rate For 2021

Manage Sales Taxes Mileage And Receipts Quickbooks Online Advanced

Sales And Use Tax Regulations Article 11

Ask The Experts Taxability Of Reimbursements For Mileage California Employee Benefits Partners

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

California Prop 22 Taxes Block Advisors

The Irs Mileage Rate Is Not Compliant With Ca Labor Code 2802 A 2 Jpg

California Considers Placing A Mileage Tax On Drivers Cbs San Francisco